Direct to Investor Lending

DSCR

Investor

Loans

2 to 8 Units Mixed-Use

Property Specialists for

Interest Only & Jumbo Mortgages

Direct to Investor Lending

DSCR

Investor

Loans

2 to 8 Units Mixed-Use

Property Specialists for

Interest Only & Jumbo Mortgages

Direct to Investor Lending

DSCR

Investor

Loans

2 to 8 Units Mixed-Use

Property Specialists for

Interest Only & Jumbo Mortgages

Amplify Your Investments. Choose Long‑Term

DSCR Mortgage Financing

Call now. Get clarity.

No gatekeeping.

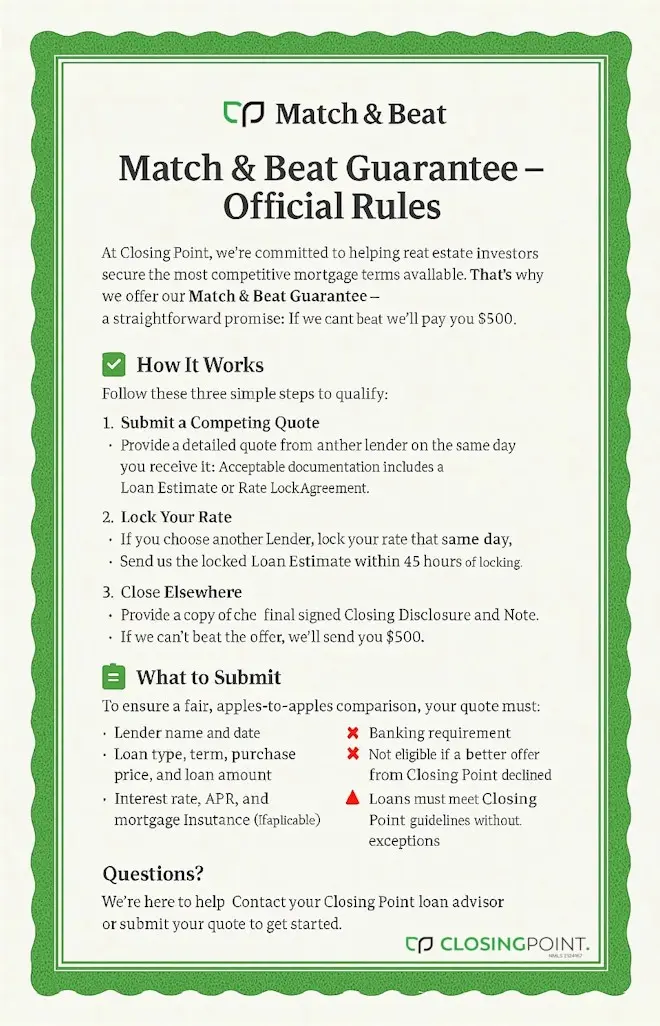

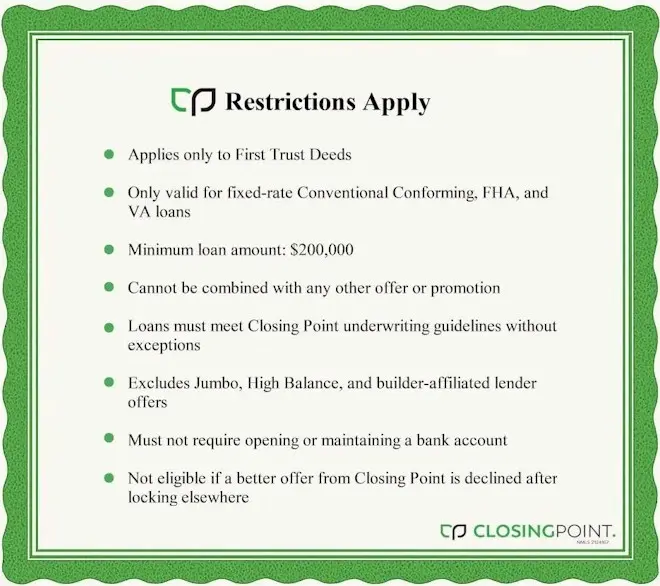

Match & Beat Guarantee Program

![]()

Match & Beat Guarantee Program

Match & Beat Guarantee

Match & Beat Rules

Restrictions

No Proof of Income Required

No tax returns or W-2s needed. Our DSCR loans rely on your credit and property cash flow—not personal income. Qualify faster and invest smarter with minimal documentation. Get Pre-Qualified Today!

Investment Property Focus

Financing that adapts to your ambition. Our mixed-use property loans for 2–8 units offer flexible terms and investor-driven solutions—up to $2M. Fuel your next move.

Why Savvy Investors Go Direct

- In-House Underwriting & Decisions Skip the middleman and get funded faster. Direct access to decision-makers means quicker turnarounds and fewer roadblocks.

- More Competitive Rates & Fees Going direct eliminates broker commissions—often resulting in lower interest rates and reduced origination fees.

- Deep DSCR Expertise As a direct DSCR lender, we bring specialized knowledge in underwriting and structuring investor-focused mortgage solutions.

- Seamless Experience One point of contact from start to finish. You’ll work with a dedicated loan officer throughout the process for a consistent, personalized experience.

Why Savvy Investors Go Direct

- Faster Closings: Skip the middleman, get funded quicker.

- Lower Costs: No broker fees means more savings for you.

- Direct Decisions: In-house underwriting for faster approvals & flexibility.

- Expert Guidance: Specialized DSCR knowledge, tailored for investors.

- Seamless Experience: One point of contact, start to finish.

- Your Growth, Accelerated: Direct access to capital for your portfolio.

1 to 4 Residential

Expand your residential portfolio. Secure DSCR financing for single-family homes or 2-4 units based on rental income, not your personal W2s. Start Your Investment!

5 to 8 Multifamily Loans

Tap into DSCR financing for small multifamily properties and grow your portfolio with flexible terms and minimal documentation. Expand Into Multifamily with Confidence!

Contact Mortgage Banker

Quick Response Form

No cost. No obligation.

NOTE: We respect your privacy.

We will never sell or share your information with spammers!

Get DSCR mortgages from ClosingPoint for rentals in: AL, AZ, CA, CO, DC, FL, GA, ID, IL, MD, MI, MN, NC, NJ, NV, OH, OK, OR, PA, SC, TN, TX, VA, and WA.

Turn Opportunity into Asset.

Get DSCR Smart Financing.

Apply Today, Risk Free. It only takes a few minutes to get started.

2 to 8 Units Mixed-Use Property DSCR Financing

Income & Documentation Requirement

- Qualify Based on Property’s Rental Income — not your personal income

- No Income Verification Required — no W-2s, tax returns, or financials needed

- No Debt-to-Income (DTI) Ratio Calculation

- No Lease Required — market rent can be determined via appraisal

- Interest-Only (IO) Feature Available — can be used to calculate DSCR

- Low Reserve Requirement — less cash needed to qualify

- No Recent Foreclosure or Bankruptcy — clean credit history required

DSCR Loan Features

⚪ Loan Amounts & Use

- Loan Purposes: Available for Purchase, Refinance, and Cash-Out

- Loan Amounts: Borrow from $500,000 to $2,000,000

- Cash-Out Option: Access up to $1,000,000 in cash

⚪ Loan Terms & Structure

- Loan Types:

∘ 30yr Fixed Rate

∘ Interest Only Option - Interest Rate Buy-Down: Available to lower upfront rates

- No Prepayment Penalty: After 5 years (shorter period available)

⚪ DSCR Requirements

- 2–8 Units Mixed-Use buildings: As low as 1.00

- Minimum Credit Score: 700 — higher FICO scores may qualify for better rates

- Investor Experience:

∘ First Time Investor – Not eligible

∘ First Time Homebuyer – Not eligible

⚪ Loan-to-Value (LTV)

- LTV for Maximum $1.5M Loan:

∘ Credit min credit score 700

∘ Purchase LTV 75%

∘ Refinance LTV 70%

∘ Cash-Out LTV 65% - LTV for Maximum $2.0M Loan:

∘ Credit min credit score 700

∘ Purchase LTV 70%

∘ Refinance LTV 65%

∘ Cash-Out LTV 65% - For CT, FL, NJ States:

∘ Purchase LTV Up to 70%, min credit score 720

∘ Refinance LTV: Up to 65%, min credit score 720

Beyond the Numbers

⚪ Direct to Investor Mortgage Lender

As a direct mortgage lender, we make all credit decisions and exceptions in-house, allowing for:

- Faster Approvals & Streamlined Communication

- Flexible Underwriting tailored to investor needs

- Competitive Rates without broker markups

- Closings in as Little as 5 Days After Appraisal

⚪ Borrower Flexibility

- No Limits on Financed Properties — grow your portfolio

- No Balloon Payments — predictable long-term structure

- Cash-Out Can Be Used to Meet Reserve Requirements — easier access to financing

- Interest-Only (IO) Option Available — reduce initial monthly payments

- LLC Ownership Allowed — maintain asset protection and privacy

- Non-Occupant Co-Borrowers Allowed — boost qualification potential

- Eligible Borrower: U.S. Citizen; Permanent Resident Alien; Non-Permanent Resident Alien — open to international investors

- Self-Employed Investors Welcome — no W-2s required

- All units are for renters—owners can’t live on-site

⚪ Strategic Benefits

- Fast & Efficient 1031 Exchange Closings — smooth transitions for tax deferral

- Excellent Product for Long-Term Investors — flexible, scalable, and sustainable

- Not a Hard Money Loan — offers better terms, rates, and stability

Eligible Property Types for DSCR Loans

⚪ Mixed-Use Properties

- 2 to 8 Units where commercial usage is Retail/Office/Restaurant:

∘ Building with 2-3 Units, limit is 1 commercial Unit

∘ Building with 4-5 Units, limit is 2 commercial Units

∘ Building with 6-8 Units, limit is 3 commercial Units

∘ Commercial space must not exceed 49.99% of the total building area - Property Condition:

∘ No fair or poor ratings

∘ No environmental issues

∘ No health or safety issues

∘ No excessive deferred maintenance

∘ No structural deferred maintenance - Rural: Not eligible

- Acreage: Property up to 2-acres, not meeting the rural definition, eligible

- Appraisals: A full interior inspection with photos is required for all units

Get a FREE Formal Lender Pre-Approval Letter

No appointments necessary

Mortgage Bankers hours 9am-6pm PT

Get the Best Mortgage Deal—Or Receive $500!!!

With ClosingPoint’s Match & Beat Guarantee, you either get the best rate—or $500.

Why Choose ClosingPoint?

- $500 Guarantee – If we can’t beat your offer, you still benefit

- Clear, Side-by-Side Comparisons – We Walk you through every detail

- Fast Pre-Approvals & Rate Locks – Quick, efficient service

- Expert Loan Advisors – Personalized support from start to finish

- No Pressure, Just Options – You stay in control

- Competitive Rates & Low Fees – Designed to save you money

Submit your competing quote today to get a FREE Formal Lender Pre-Approval Letter

Email: [email protected]

or Call: (833) 833-5585

Call now. Get clarity. No gatekeeping.

DSCR Long-Term Mortgage for Mixed-Use property, Orlando FL

DSCR 30yr Fixed Mortgage for Mixed-Use building

![]()

REFINANCE.

INVEST.

GROW.

2 to 8 Units Mixed-Use Property Financing

Multiply Your Assets with DSCR Loans

Turn Rental Property

Equity Into Cash

New Mortgage, Simplified!

Get your DSCR Mortgage with just your credit and down payment—or your refinance equity. We’ve eliminated the red tape: no income verification, employment history, DTI, tax returns, or financial documents required.

Hard Money? Think Again.

Get DSCR Loans: The Strategic Choice for Residential Real Estate Investors

Elevate your investment strategy. Stop settling for high-cost, short-term hard money loans. DSCR loans are your intelligent pivot to stable, long-term financing designed for serious real estate investors.

Tap into capital based on your property’s income, not your personal tax returns. This means faster approvals, fewer roadblocks, and the power to scale your portfolio with confidence, maximizing your returns and minimizing traditional loan headaches.

Match & Beat Guarantee Program

Match & Beat Guarantee

Match & Beat Rules

Restrictions

![]()

ClosingPoint

![]()